An overview: sugar industry all over the world

According to a report by MarketsandMarkets, the global sugar market is $46.4 billion in 2023 and is projected to reach $59.1 billion by 2028. The market will grow at a CAGR of 5% between 2023 and 2028, owing to increasing demand for processed food and beverages.

Brazil, India, and China lead the countries that produce the most sugar; these nations collectively make up 41% of the global production. If we talk about Brazil, its hold in the sugar industry is powered by expansive sugarcane fields and a favorable climate. However, a substantial portion of Brazil’s sugarcane harvest is diverted to ethanol production due to government mandates and global biofuel demand. On the other end of the supply chain, the United Arab Emirates, Brazil, Cuba, and Malaysia are the Countries With The Highest Sugar Consumption.

Sugar business is divided into sugarcane business and sugar beet business.The white, refined sugar we see comes from either sugar cane or sugar beet, the two sugar crops whose growth determines a country’s ability to produce processed sugar. Sugarcane is native to tropical regions in South Asia and is the world’s largest crop in production, with over 1.966 billion tons produced in the previous crop year. Once cut, the cane stalks are crushed to extract the juice, which is then purified and crystallized to produce raw sugar.

Intriguingly, sugar beet is a root crop that many don’t presume is a source of sugar, but it very much is. Of the 20 countries that produce the most sugar, four heavily rely on sugar beet, namely the United States, Russia, Ukraine, and France, as the crop primarily grows in the cooler climates of the Northern Hemisphere.

Sugarcane is also the most consumed crop in the world, as its global consumption reached 1.966 billion tons in the crop year 2021/2022.

Top 15 sugar companies in the world

1. Cargill, Incorporated

2023 Actual Revenue: $177.0 billion

Let me tell you all about Cargill, the sugar giants of North America! They’re rocking the sugar game with a lineup that includes everything from granulated sugar to liquid sucrose. And get this – they’ve got the goods like Brown Sugar, Granulated Sugar, Liquid Sucrose, Mexican Estandar Sugar, and Mexican Refined Sugar.

Plus, they’re teaming up with Louisiana Sugar Refining, LLC to bring that sweet stuff to customers all across North America. Cargill is definitely stirring up some sugary magic in the industry!

2. Wilmar International Limited

2023 Actual Revenue: $67.2 billion

So, Wilmar International Limited from Singapore is a major player in the sugar world with over 300 subsidiary companies. Founded in 1991, they’re a big deal in the agribusiness scene alongside COFCO Group. They’ve got sugar operations from plantations to supermarket shelves with mills and distilleries worldwide.

3. Louis Dreyfus Company B.V.

2022 Actual Revenue: $59.9 billion

Louis Dreyfus Company B.V. are like the sugar giants of the world! Based in France, they’re not just about sugar; they’re big shots in agriculture, food processing, shipping, and finance. A top player in global sugar merchandizing, they’re making waves in 14 countries, armed with killer market know-how and research skills. Serving up both raw and refined sugar, they’ve got all the sweet stuff covered.

4. Associated British Foods plc (LSE:ABF.L)

2023 Actual Revenue: $25.19 billion

Associated British Foods plc isn’t just your average food company – they’re a global powerhouse in the sugar game! With a hand in diversified food, ingredients, and retail, this company knows how to do it big. They’ve got five key segments, including Grocery, Ingredients, Agriculture, Sugar, and Retail. The Sugar division is all about that sweet stuff – growing, processing, and selling sugar beet and sugar cane to industrial pals. And get this – their ingredients branch is the world’s second-largest producer of sugar and baker’s yeast, plus a big player in other key ingredients like emulsifiers and enzymes.

5. Biosev & Raizen

2023 Actual Revenue: $39.0 billion

Biosev, as acquired by Raizen in 2021, is crushing it in the sugar and alcohol world! They’re like the sugar and ethanol kings with 11 production units spread all across Brazil, churning out a massive 36.4 million tons of sugarcane per year. These guys are the real deal, serving up sugar, ethanol, and all kinds of cool stuff like animal feed, yeast, and molasses powder for markets both at home and around the globe. And guess who’s on their customer list? Only the big shots like Nestlé, Coca-Cola, AmBev, Kraft, Dori, and Unilever – talk about a sweet deal!

6. Südzucker AG (XETRA:SZU.DE)

Fiscal 2023/24 Forecasted Revenue: $11 billion

Südzucker AG (XETRA:SZU.DE) – they’re not just any sugar maker; they’re killing it on a global level! Based in Germany but spreading their sweetness across the EU, the UK, and beyond, they’re a big name in the game. Slicing things up into five cool segments – Sugar, Special Products, CropEnergies, Starch, and Fruit – they’ve got their hands in all things sweet and more. The Sugar crew is out there producing and selling all sorts of sugary delights, like sugar, specialty products, glucose syrup, and even animal feed.

7. Cosan S.A. (São Paulo:CSAN3.SA)

2022 Actual Revenue: $7.9 billion

Cosan S.A. (São Paulo:CSAN3.SA), a top-notch sugar company known globally, is a publicly-listed Brazilian powerhouse that deals in bioethanol, sugar, and energy. They’re spreading their sweet influence across Brazil, Argentina, Uruguay, Paraguay, and Bolivia. With a robust production record of 5.4 million tons of sugar to date, they stand tall as a major exporter in the sugar world. Cosan S.A. (São Paulo:CSAN3.SA) focus on Very High Polarization (VHP) sugar and the production of organic and liquid sugar has positioned them as industry innovators. Their stellar performance across all sectors in their business lineup is truly remarkable!

8. Savola Group

2023 Actual Revenue: $7.2 billion

Let me tell you about Savola Group – they’re like the sugar kings of Saudi Arabia, whipping up not just sugar, but also cooking oils, pasta, and ghee. With a presence in over 50 countries, they’re making a sweet splash globally. When it comes to sugar, they’re all about Al-Osra, offering both coarse and fine sugar varieties, along with other brands catering to different market segments.

9. Tereos

2023 Actual Revenue: $7.1 billion

Tereos – they’re like the sugar kings of the world! This cooperative conglomerate is all about those sweet agricultural goods, think sugar, alcohol, and starch. With a whopping 44 factories spread out across nine countries like Brazil, India, Indonesia, and more, they’ve got about 20,000 folks powering the sugar rush.

10. E.I.D.- Parry (India) Limited (NSE:EIDPARRY.NS)

2023 Actual Revenue: $4.2 billion

E.I.D.- Parry (India) Limited (NSE:EIDPARRY.NS) from India is on top of the sugar world game! Headquartered in the bustling city of Chennai, these sugar wizards have been stirring up sweet success since way back in 1788.

11. Mitr Phol Group

2022 Actual Revenue: $3.9 billion

Check it out – Mitr Phol Group isn’t just any sugar crew; they’re the big shots in Thailand and all of Asia when it comes to sugar and bio-energy. This privately owned group, run by the Vongkusolkit fam, has been crushing it since ’93 when they put down roots in China with 6 sugar mills in Guangxi County. They’ve earned their stripes as the second largest sugar producer in China, cranking out a cool 10 million tons of cane yearly, which translates to around 1.3 million tons of sugar per year.

12. Cofco Sugar Holding CO.,LTD. (Shanghai:600737.SS)

2022 Actual Revenue: $3.7 billion

Cofco Sugar Holding CO.,LTD. (Shanghai:600737.SS), is rocking the sugar scene as a top player in China and beyond. They’re all about sugar and tomato processing, offering a whole buffet of sweet stuff like cane, beet, refining sugar, and more. Cofco Sugar Holding CO.,LTD. (Shanghai:600737.SS) reach is global, with exports hitting about 80 countries and regions, including big shots like the U.S., Europe, Southeast Asia, Japan, South Korea, and the Middle East.

13. Ros Agro PLC (MCX:AGRO.ME)

2023 Actual Revenue: $3.0 billion

Picture this: Ros Agro PLC (MCX:AGRO.ME) is like the sugar boss in Russia, churning out beet sugar like nobody’s business. They also make their mark in pork, agri goods, and oils and fats scenes domestically. By the end of 2023, they had around 23.1 thousand employees and raked in about $3 billion in total revenue. Ros Agro PLC (MCX:AGRO.ME) is definitely making some sweet moves in the sugar world!

14. Nordzucker AG

2023 Actual Revenue: $2.5 billion

So here’s the scoop on Nordzucker AG – these sugar wizards are all the way up there as Europe’s second-largest sugar maker, hanging their hats in Braunschweig, Germany.

15. DCM Shriram Limited (NSE:DCMSHRIRAM.NS)

2023 Actual Revenue: $1.4 billion

DCM Shriram Limited (NSE:DCMSHRIRAM.NS) is a big shot in India, rocking the business world with a mix of goodies like Urea, Sugar, Ethanol, and all things Farm Solution. They’ve got sugar factories in Uttar Pradesh, churning out a whopping 41,000 TCD (tonnes crushed of sugarcane daily) and power up to 166MW.

Sugar Industry Process

The sugar industry processes from harvesting sugarcane or sugar beets to refining them into various types of sugar.

Harvesting: Sugarcane or sugar beets are harvested when they reach maturity. Sugarcane is typically manually cut while sugar beets are mechanically harvested.

Transportation to Mill: After harvesting, the sugarcane or sugar beets are transported to processing mills for further extraction.

Extraction: The extraction process differs for sugarcane and sugar beets:

Sugarcane: Sugarcane is crushed to extract the juice. Sugar Beets: Sugar beets are sliced and then subjected to hot water extraction to obtain the sugar-containing liquid. Clarification: The extracted juice undergoes a clarification process to remove impurities and non-sugar components.

Evaporation: The clarified juice is concentrated through evaporation to form a thick syrup.

Crystallization: The concentrated syrup is then seeded with sugar crystals, initiating the crystallization process.

Separation: Crystals are separated from the remaining liquid, known as molasses, through centrifugation.

Drying: The sugar crystals are dried to remove excess moisture.

Refining (Optional): Depending on the desired end product, the sugar may undergo additional refining processes to produce white or specialty sugars.

Packaging: The refined sugar is packaged into various containers such as bags, boxes, or bulk containers for distribution and sale.

Is sugar business profit

Sugar business can be profitable, and here are some examples:

Sugar Industry in India

India is one of the largest producers and consumers of sugar globally. In India, the sugar industry contributes significantly to the agricultural economy and provides employment opportunities. Companies like Bajaj Hindusthan Sugar Ltd, Balrampur Chini Mills Ltd, and Dhampur Sugar Mills Ltd are prominent players in the Indian sugar industry.

Sugar Companies in the USA

Several sugar companies operate in the United States, including American Crystal Sugar Company, Florida Crystals Corporation, and Imperial Sugar Company. These companies produce various sugar products, including refined sugar, specialty sugars, and sugar-based food products, catering to both domestic and international markets.

Sugar Business in Kenya

Kenya has a growing sugar industry, with both private and state-owned sugar companies operating in the market. Sugar profitability in Kenya can be affected by factors like imported sugar competition, high production costs, and inefficiencies in the supply chain. Despite these challenges,

Sugar Business in Pakistan

Pakistan has a significant sugar industry, with a large number of sugar mills producing both white and brown sugar. The profitability of the sugar business in Pakistan can be affected by factors such as government policies, sugarcane prices, and market demand. Despite challenges such as fluctuating sugar prices and regulatory issues, some Pakistani sugar companies have managed to maintain profitability through efficient operations and export opportunities.

How to start sugar business

A sugar business can be a complicated undertaking, requiring various steps and considerations. Getting started in sugar business is easy if you follow these steps:

Market Research

Identify your target market’s sugar demand, competitors, pricing dynamics, and potential customers by conducting thorough market research. Assess your sugar business’s potential niches and opportunities.

Sugar Business Plan

Plan your business goals, target market, marketing strategies, operational plan, financial projections, and potential risks. Your sugar business plan should serve as a roadmap.

Legal and Regulatory Compliance

Learn about the legal and regulatory requirements for starting a sugar business in your area. Food processing or manufacturing businesses must obtain all necessary licenses, permits, and registrations.

Procurement of Raw Materials

To produce sugar, ensure that raw materials, such as sugarcane and sugar beets, are continuously and reliably available. Ensure a steady supply chain by establishing relationships with farmers, suppliers, or wholesalers.

Production Facility

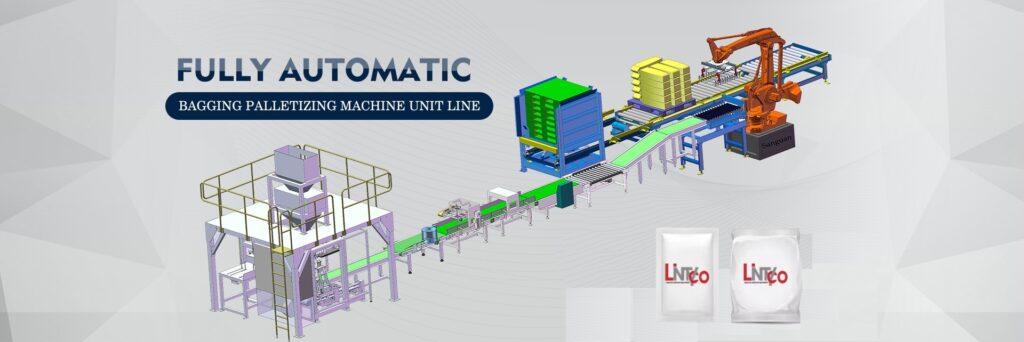

Obtain all the necessary equipment and machinery for extracting, processing, and packaging sugar. Consider factors such as location, space requirements, utilities, and safety regulations when selecting a production site. Regarding the sugar packing machine, you can contact Lintyco for help.

Quality Control

Make sure your sugar products are pure, consistent, and safe throughout the production process. Invest in quality testing equipment and procedures to maintain high product standards.

Distribution and Logistics

Establish an effective distribution strategy for reaching your target market. Determine the most cost-effective and efficient transportation and logistics methods for delivering your sugar products to customers, retailers, or distributors.

Branding and Marketing

Create a strong brand identity for your sugar business and develop marketing strategies to promote your products. To increase awareness and attract customers, utilize various marketing channels, such as online advertising, social media, trade shows, and partnerships.

Financial Management

Keep a close eye on your expenses, revenues, and profitability. Make a financial plan for your sugar business in order to allocate resources effectively, secure funding, and ensure its long-term financial sustainability.

Adaptation and Growth

Keep up with market changes, consumer preferences, and industry trends. Continuously innovate and diversify your product offerings to stay competitive and capitalize on new opportunities for growth.