The 3 AM Phone Call No Procurement Manager Wants

It’s 2:47 AM when your phone rings. A shipment of industrial solvents has been rejected at the German border—improper UN markings. The container is quarantined, your customer’s production line is stopped, and you’re facing €85,000 in demurrage fees, expedited re-packaging costs, and potentially losing your largest European account.

The culprit? A packaging “detail” overlooked six months ago when you approved a new supplier to save 8% on container costs.

In the chemical industry, packaging isn’t just about finding a bucket that fits your budget. It’s about navigating a minefield of regulations where one compliance failure can trigger cascading consequences—environmental leakage, border rejections, factory accidents, and severe legal liability. For procurement professionals, the real question isn’t “Can I find a cheaper supplier?” but rather: “What is the safest, most compliant, and genuinely cost-effective chemical packing solution for my specific materials and supply chain?”

After working with over 200 chemical manufacturers across 15 years, we’ve seen the same patterns repeat: companies that treat packaging as a commodity inevitably pay 5-10X more in hidden costs than those who engineer it as a risk control system from day one.

This guide is designed to help you avoid becoming that 3 AM phone call story.

What Every Procurement Manager Needs to Know First

Before you even open a supplier RFQ, you need to understand one fundamental truth: chemicals aren’t “hazardousized” by their names or applications—they’re classified by how they behave when things go wrong.

The Four Hazard Profiles That Determine Everything

1. Flammable Materials

These substances ignite easily and pose significant fire risks during storage and transport. Think solvents, alcohols, and petroleum distillates. The wrong packaging material can react with flammable contents, increasing fire hazard exponentially. Metal containers with proper grounding are typically required.

Real Cost Impact: A food flavoring manufacturer we worked with was using plastic IBCs for alcohol-based extracts—technically possible, but their insurance carrier flagged it during an audit. The resulting packaging changeover cost $47,000 and delayed two product launches.

2. Corrosive Substances

Materials that degrade surfaces, damage tissue, or eat through containers. This category includes acids, bases, and certain industrial cleaners. Packaging materials and contents must be such that there will be no significant chemical or galvanic reaction between materials and contents.

Real Cost Impact: Corrosive materials require specialized linings and coatings. A coatings manufacturer learned this the hard way when acidic additives degraded standard drum linings over 90 days, contaminating $180,000 worth of product before anyone noticed.

3. Toxic Chemicals

Harmful if inhaled, ingested, or absorbed through skin. This isn’t just about “poison” labels—many industrial intermediates fall into this category. The packaging must provide absolute containment with zero leakage tolerance.

Real Cost Impact: Toxic materials typically require UN Packing Group I or II certification, which adds 15-30% to packaging costs. However, downgrading to save money can result in rejected shipments and liability exposure that dwarfs any savings.

4. Reactive Materials

Substances that react violently with air, water, or other materials. These are the most challenging to package and often require specialized inert atmospheres or stabilizers.

Real Cost Impact: A specialty chemicals distributor once mixed reactive powder with standard vermiculite packing material. The vermiculite contained trace moisture. The resulting exothermic reaction damaged the entire pallet and triggered a hazmat investigation. Total cost: $92,000 plus 6 months of regulatory reporting.

Three Questions That Matter More Than Price

Before requesting quotes, answer these honestly:

- What is the physical state and behavior of the material under stress? (Heat, vibration, pressure changes during transport)

- Is this material corrosive, volatile, or reactive with common packaging materials? (Don’t assume—verify with data)

- Will this product cross international borders, and which regulatory jurisdictions apply? (ADR for Europe, IMDG for sea, IATA for air, 49 CFR for USA)

If you can’t answer all three with specific data—not assumptions—you’re not ready to evaluate packaging options yet.

Your SDS Is Not Bureaucratic Paperwork

Most procurement teams treat Safety Data Sheets as compliance documents to file away. That’s exactly backward. Safety Data Sheets provide detailed information about chemical properties, handling instructions, and emergency measures that are essential for selecting appropriate packaging.

Think of your SDS as a technical specification sheet that tells you:

What the SDS Actually Reveals About Packaging

Section 7 (Handling and Storage): This tells you the compatible materials. If it says “Store in stainless steel or polyethylene containers,” that’s not a suggestion—it’s engineering guidance based on reactivity testing. Ignore it, and you’re betting your budget that the chemists who formulated the product were wrong.

Section 9 (Physical and Chemical Properties): The flash point, vapor pressure, and pH data here determine whether you need pressure-relief valves, whether plastic or metal is safer, and what temperature tolerances your packaging must handle during transport.

Section 10 (Stability and Reactivity): This section might save your company from a catastrophic incident. It identifies incompatible materials that could trigger reactions—information that’s critical when selecting gaskets, valve materials, and even the packing materials used to secure containers during transit.

Section 14 (Transport Information): This is where the UN number, proper shipping name, packing group, and transport restrictions live. These aren’t optional details—they determine which packaging is legally authorized for your shipment.

The Certification Trap

Here’s where many procurement teams stumble: your supplier’s assurance that they’re “experienced with chemicals” means nothing if they can’t demonstrate familiarity with your specific SDS.

Red Flag Warning: If a packaging supplier doesn’t ask for your SDS before quoting, they’re guessing. And in hazardous materials packaging, guessing is expensive.

We worked with a pharmaceutical intermediate manufacturer whose previous supplier had been providing “suitable” containers for three years. When they finally had a chemist review the SDS against the packaging materials, they discovered the drum liner material was slowly being degraded by trace organic solvents. The product remained safe, but contamination levels were gradually increasing. The issue was only caught during a customer quality audit—six months before it would have triggered batch rejections.

Cost of Not Reading the SDS: $340,000 in rework, re-packaging, and customer relationship repair.

Industrial Chemical Packaging Options: What Actually Works (and What’s a Liability)

The packaging world has dozens of options, but for hazardous chemicals, three formats dominate for good reason. Each has distinct advantages, hidden costs, and ideal use cases.

Steel and Plastic Drums: The Industrial Workhorse

The standard 200-liter (55-gallon) drum remains the backbone of chemical transport for a reason: it’s proven, versatile, and universally understood across the supply chain.

What Procurement Often Misses:

- Internal coatings matter enormously. A standard steel drum costs $45-65. The same drum with a phenolic epoxy lining suitable for aggressive chemicals costs $85-110. That $40 difference prevents $5,000 worth of product contamination.

- UN certification isn’t permanent. Plastic drums have UN approval that expires after 5 years, so the date of manufacture must be checked. Using expired drums violates transport regulations even if they appear pristine.

- Seal quality determines insurance liability. High-performance gasket seals cost $3-8 more per drum but can make the difference between a minor spill contained within secondary packaging and a major environmental incident.

Best For: Materials requiring 50-220 liter capacity, shipments to multiple destinations where standardized handling is critical, or operations where reconditioning and reuse programs are established.

Hidden Costs to Budget: Drum disposal or reconditioning typically runs $12-25 per unit, depending on contamination level. For hazardous materials, some drums require specialized cleaning that can cost $40-70 per unit—making single-use drums sometimes more economical than reusable ones.

Intermediate Bulk Containers (IBCs): Efficiency at Scale

IBCs typically hold around 1,000 liters and provide approximately 25% more storage capacity than four 200-liter drums on the same pallet footprint. For operations handling bulk liquids, this capacity advantage translates directly to reduced logistics costs.

The Real-World Economics:

A specialty solvents distributor we worked with analyzed their total cost per liter delivered:

- Drums: 5 drums per pallet = 1,000L total

- Filling time: 45 minutes for 5 drums

- Pallet utilization: 1,000L per pallet

- Transport cost per liter: $0.32

- Total handling touches: 5 fill operations + 5 seal operations + 5 label operations

- IBC: 1 container per pallet = 1,000L total

- Filling time: 12 minutes for 1 IBC

- Pallet utilization: 1,000L per pallet

- Transport cost per liter: $0.24

- Total handling touches: 1 fill + 1 seal + 1 label

The result: By switching from drums to IBCs, companies often report significant reductions in overall packaging-related costs driven by improved operational efficiency and lower handling, storage, and disposal expenses. This particular distributor calculated 18-month payback on their IBC investment even after accounting for higher unit costs.

What They Don’t Tell You:

Reconditioning vs. Replacement Trade-Off: IBCs can be professionally cleaned and recertified for reuse, but contaminated packaging must be removed and recovered in an efficient, compliant, and environmentally sustainable manner. Reconditioning costs $85-150 per IBC. Factor in logistics to/from the reconditioning facility, and you’re at $120-200 total cost per cycle. After 3-4 reconditioning cycles, most IBCs have cost more than buying new single-use alternatives.

Alternative Strategy: Some operations are switching to single-use IBC liners within reusable cages. The liner costs $40-60, the cage lasts 10+ years, and you avoid reconditioning logistics entirely.

Best For: Operations processing 3,000+ liters/day of compatible materials, shipments to repeat customers where empty IBC return logistics are established, or bulk liquid products where dispensing efficiency at the customer site matters.

Space Efficiency Reality: IBCs can be stacked up to four high without additional pallets due to their composite design with built-in pallet bases. This vertical stacking capability often saves more warehouse space than the raw capacity advantage alone.

Flexible Packaging and Bag-in-Box: Handle With Extreme Caution

There’s growing interest in flexible packaging for chemicals—it’s lighter, uses less material, and appears more sustainable. But here’s the reality for hazardous materials: flexibility often equals vulnerability.

When It Works: Non-reactive powders with stable chemistry, products shipping short distances with minimal handling, or materials that will be immediately consumed upon arrival (no storage period).

When It Fails Catastrophically: Anything reactive, corrosive liquids, materials requiring multi-week storage, or shipments exposed to rough handling during intermodal transport.

The Incident That Changed Our Recommendation: A powder coatings manufacturer switched to flexible bulk bags for a mildly hygroscopic material. The bags were supposed to be sealed with inert packing. The supplier used standard vermiculite. During a summer shipment, temperature fluctuations caused minor condensation. The vermiculite’s moisture content triggered caking in the powder. 18 tons of product became unusable. The issue wasn’t the flexible bag—it was that flexible packaging requires flawless execution of every detail, and supply chain reality rarely delivers flawless execution.

Procurement Lesson: Flexible packaging can work brilliantly for the right applications, but it leaves zero margin for error. Unless your entire supply chain—from filling to final delivery—is tightly controlled, stick with rigid containers for hazardous materials.

Question about Packaging Equipment Selection

The container is only half the equation. How you fill it determines product quality, worker safety, and whether your line runs profitably or becomes a liability.

Liquid Chemical Filling: Precision Under Pressure

Liquid filling for hazardous chemicals isn’t about speed—it’s about control. The machinery must deliver accurate volumes while preventing operator exposure to vapors, splashes, and spills.

Pump-Based Systems (Peristaltic or Piston):

These mechanically displace liquid, making them ideal for viscous materials or chemicals that need gentle handling. Peristaltic pumps never contact the product (the liquid stays inside tubing), making them perfect for highly corrosive materials.

Cost Reality: Pump-based systems run $15,000-45,000 depending on automation level. The pumps themselves require maintenance every 6-12 months, with replacement pump heads running $800-2,500.

Best For: Acids, bases, thick slurries, or materials where cross-contamination between batches would be catastrophic.

Flow Meter Systems (Magnetic or Coriolis):

These measure flow rate electronically and are incredibly accurate for thin-to-medium viscosity liquids. For corrosive materials, closed-loop systems with PTFE-lined components are essential to prevent fumes and accidental contact.

Cost Reality: Flow meter fillers run $25,000-75,000. The meters themselves rarely fail, but valve seals and sensor drift can cause accuracy issues if preventative maintenance is skipped.

Best For: Solvents, oils, and chemicals where ±0.1% fill accuracy matters for regulatory or quality reasons.

The Hidden Cost Everyone Forgets: Vapor Management

Here’s what separates amateur operations from professional ones: a $50,000 filling machine is useless if operators won’t run it because fume exposure makes them sick.

Every liquid chemical filler for hazardous materials needs integrated vapor capture. This isn’t a “nice to have” safety feature—it’s what makes the line operationally viable. Proper ventilation requires mechanical systems to clear vapors at the source, not just opening vents.

Budget Reality: Adding proper fume extraction to a filling line costs $8,000-18,000 depending on air volume requirements. Not having it costs you in turnover, sick days, OSHA complaints, and eventually a stop-work order that shuts down your line entirely.

Lintyco Advantage: Our liquid filling systems integrate vapor capture as standard equipment, not an add-on. We’ve learned that trying to retrofit ventilation after installation costs 2-3X more than designing it in from the start. See our complete Liquid Filling Machinery Guide for detailed specifications on closed-loop filling systems.

Powder and Granular Chemical Filling: Where Dust Control Is Everything

Powder packaging for hazardous chemicals presents a unique challenge: you need precision dosing while preventing any dust from escaping into the work environment.

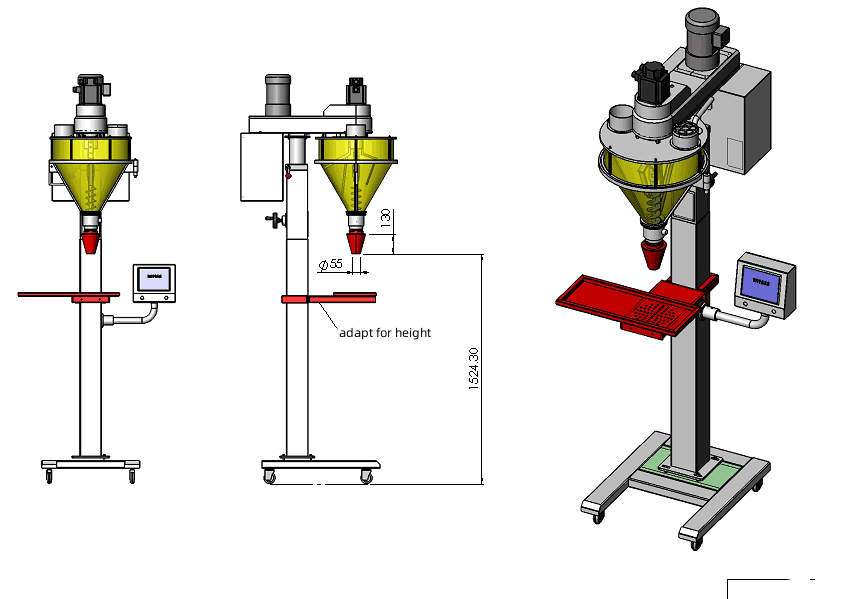

Auger Fillers (Screw Conveyor Design):

A rotating auger precisely meters powder into containers. These systems offer excellent accuracy (±0.5-2% depending on material flow characteristics) and can handle a wide range of powder types.

Critical Feature: The hopper must be completely sealed with integrated dust extraction. Open-hopper auger fillers are common in food applications but completely inappropriate for hazardous chemical powders.

Cost Reality: Sealed auger fillers suitable for hazardous powders run $28,000-65,000. The auger screw itself is a wear component requiring replacement every 12-24 months ($1,200-3,500 depending on material and coatings).

Net Weigh Systems with Vibration Control:

These systems fill containers on a scale, using vibration feeders to control flow rate. They’re slower than augers but offer superior accuracy for expensive materials where every gram matters.

Cost Reality: Net weigh systems run $35,000-85,000. They’re mechanically simpler than augers (less maintenance) but require more floor space and have longer cycle times.

The Explosion-Proof Requirement:

If you’re packaging combustible powders (many organic chemicals, certain metal powders, fine-particle materials), your entire filling system must be ATEX or IECEx certified for explosive atmospheres. This isn’t optional—it’s legally mandated.

Cost Impact: Explosion-proof electrical components add 30-50% to equipment cost. A standard auger filler might cost $35,000; the explosion-proof version costs $52,000. But consider the alternative: a dust explosion can level a facility. The incremental cost is insurance you hope to never need but absolutely must have.

Lintyco Advantage: Our powder filling systems for chemicals are designed with integrated dust control hoods, explosion-proof electrical components as standard, and contamination-free product pathways. We’ve specialized in raw chemistry powder packaging machinery specifically because the engineering requirements are so demanding that many general packaging equipment suppliers can’t meet them reliably.

The Safety Systems That Prevent 3 AM Phone Calls

Technical equipment matters, but the environment around that equipment determines whether your operation is genuinely safe or just accident-free until it isn’t.

Active Ventilation: Engineering Out the Hazard

There’s a dangerous misconception about ventilation: that opening a few vents or running some exhaust fans counts as “adequate ventilation.” It doesn’t.

Proper ventilation requires mechanical systems designed to remove vapors at the source, not general air circulation hoping to dilute contamination. The difference is capture velocity—the air speed required to physically pull vapors away from the breathing zone before they disperse.

What Proper Ventilation Looks Like:

- Source capture hoods directly over filling points (not general ceiling exhausts)

- Negative pressure in the filling area (air flows toward hazards, not toward workers)

- Continuous air monitoring with alarms for vapor concentration thresholds

- Makeup air systems to replace exhausted air without creating pressure imbalances

Budget Reality: A properly designed local exhaust ventilation (LEV) system for a 2-station filling line costs $25,000-55,000 installed. That sounds expensive until you price out your alternative: managing worker exposure claims, regulatory citations, or production shutdowns due to safety complaints.

The Insurance Factor: Many carriers now require documented ventilation systems with air monitoring for operations handling volatile hazardous materials. Having it isn’t just good practice—it’s becoming a condition of coverage.

Emergency Response Infrastructure: Planning for When Things Go Wrong

Hope is not a strategy. Every operation handling hazardous chemicals needs immediate-response capability for spills and exposures.

The Four-Layer Emergency System:

Layer 1 – Spill Containment:

Secondary containment sufficient to hold 110% of the largest container volume on-site. This is usually mandated by regulation, but many operations treat it as a formality rather than engineering it properly.

Layer 2 – Absorbent Materials:

Chemical-specific absorbents staged near filling stations. Not all absorbents work with all chemicals—some materials react violently with certain chemicals. Specialized decontamination solutions like Diphoterine are essential for chemical exposure emergency response.

Layer 3 – Emergency Eyewash and Showers:

ANSI Z358.1 compliant stations within 10 seconds (about 55 feet) of any chemical handling area. These need weekly testing and annual inspection. Non-compliance is one of the most commonly cited OSHA violations.

Layer 4 – Emergency Communication:

Direct communication to emergency services without requiring workers to leave the area. This can be panic buttons, emergency phones, or radio systems—whatever ensures help can be summoned immediately.

Cost Reality: Basic emergency infrastructure (secondary containment, absorbents, eyewash station, and signage) for a small filling operation runs $8,000-15,000. For larger operations with multiple stations, figure $25,000-50,000.

Perspective Check: That investment seems reasonable when you consider that the average hazardous chemical spill costs $42,000 in cleanup, reporting, and investigation—assuming nobody is injured and no environmental damage occurs. The emergency infrastructure pays for itself the first time it prevents a small incident from becoming a major one.

Sustainability in Chemical Packaging

Sustainability conversations in chemical packaging often veer into unrealistic territory. Let’s address what’s actually viable today versus what’s aspirational thinking that could compromise safety.

What Works Now: Practical Sustainability

Reusable IBCs with Professional Reconditioning:

This is the proven path for reducing packaging waste. Licensed IBC reconditioning facilities clean, inspect, and recertify containers to like-new condition, extending useful life to 7-10 years before material degradation requires retirement.

Economic Reality: Professional reconditioning costs $85-150 per cycle, but eliminates the environmental and financial cost of disposing and replacing IBCs. For operations with volume to justify return logistics, this typically achieves 40-60% packaging cost reduction over 5 years while dramatically reducing waste.

Standardized Recyclable Drums:

Steel drums have the highest recycling rate of any industrial packaging—over 80% of steel drums are recycled at end of life. HDPE plastic drums, while lower (around 30% recycling rate), can be effectively recycled where infrastructure exists.

The Key: Standardization. Using consistent drum specifications across your product line makes recycling logistics feasible. Mixing drum types fragments your waste stream and usually means everything ends up landfilled.

What Doesn’t Work (Yet): Innovation Theater

The packaging industry is full of exciting sustainability innovations—mushroom-based packaging, seaweed plastics, biodegradable polymers. These materials show promise for consumer goods and food products.

But for hazardous chemicals? None of these materials currently meet the rigorous performance standards required for hazardous materials transport. Packaging must pass extensive testing and meet strict compatibility requirements with chemical contents—requirements that biobased materials haven’t yet demonstrated they can meet consistently.

The Procurement Position: Don’t sacrifice compliance and safety chasing sustainability headlines. Focus on proven reuse and recycling strategies while monitoring emerging materials for future applicability.

Future Watch: Hybrid containers with recyclable structural components and replaceable chemical-resistant liners show real promise. These maintain safety and compliance while reducing material consumption. We expect these to become mainstream in 3-5 years.

The Procurement Checklist: Preventing the $500K Mistake

Before you approve any chemical packaging supplier or specification, verify every item on this checklist. Each point represents a real failure mode that has cost real companies real money.

Pre-Approval Technical Review

☐ Does the packaging material match SDS compatibility requirements?

Don’t rely on supplier claims. Cross-reference Section 7 of your SDS against the specific materials of construction (liner materials, valve components, gasket materials).

☐ Is UN/DOT certification current and appropriate for your material?

Verify the UN marking code matches your material’s packing group, hazard class, and physical state. All packages must undergo rigorous testing before being considered UN approved, with approval markings clearly printed or embossed.

☐ Have seal and closure systems passed third-party testing?

Supplier claims mean nothing. Require documented drop tests, pressure tests, and stack tests from accredited testing laboratories.

☐ Is the filling equipment rated for hazardous area classification?

If your material is flammable or produces combustible dust, all electrical components must be ATEX/IECEx rated. This isn’t negotiable—it’s code.

☐ Does ventilation design meet capture velocity requirements?

General air changes per hour (ACH) calculations aren’t sufficient. You need face velocity measurements at each capture hood (typically 100-200 feet per minute for chemical vapors).

Operational Risk Assessment

☐ What is the documented failure rate for this packaging configuration?

Insist on failure data from the supplier’s existing installations. If they can’t provide it, they haven’t been tracking it—which means they don’t know how their packaging performs long-term.

☐ How will packaging performance degrade over storage time?

Some packaging materials degrade in contact with chemicals even when they’re “compatible.” Ask about maximum storage duration before integrity testing is required.

☐ Is supply chain continuity assured for 24+ months?

Chemical operations can’t afford packaging discontinuity. Verify your supplier’s production capacity, raw material sourcing, and backup manufacturing capability.

☐ What is the total cost of ownership including disposal/reconditioning?

The invoice price is just the starting point. Model TCO including filling time, storage footprint, handling costs, return logistics (if reusable), and end-of-life disposal.

☐ Who provides technical support when issues arise?

When you have a 2 AM filling line failure, who answers the phone? Verify 24/7 technical support availability before committing to any specialized equipment.

Compliance and Documentation

☐ Can the supplier provide complete regulatory documentation package?

This includes material certificates, UN test reports, declaration of conformity, and compatibility statements specific to your chemicals.

☐ Is there a documented change control process?

Packaging specifications can’t change without your approval and re-validation. This must be contractually guaranteed.

☐ Are training materials and SOPs provided for your operators?

Equipment is useless if your team can’t operate it safely and effectively. Comprehensive training documentation should be included, not an afterthought.

How Top-Performing Teams Approach Chemical Packaging

After working with hundreds of chemical manufacturers and distributors, we’ve identified consistent patterns that separate the high-performing procurement teams from those constantly firefighting problems.

Treat Packaging as Risk Management, Not Commodity Purchasing

The lowest-price supplier is rarely the lowest-cost solution when you account for the total cost of failure. One rejected shipment, one contamination event, or one safety incident will cost more than you’d save in a decade of price optimization.

High-Performing Approach: Top procurement teams establish preferred supplier relationships with packaging specialists who demonstrate deep engineering expertise specific to chemical applications. They negotiate on total value (reliability, technical support, responsiveness, supply assurance) rather than exclusively on unit price.

Cost Impact: Companies using this approach report 60-75% fewer packaging-related incidents and 40% lower total packaging costs despite paying 5-12% higher unit prices for containers.

Engineer Solutions Early, Not After Problems Emerge

Most packaging failures stem from trying to fit an existing material into existing packaging rather than engineering the right solution upfront.

High-Performing Approach: Engage packaging engineering specialists during product development and formulation—before you’ve committed to specific containers. This is when you have maximum flexibility to optimize packaging for performance rather than trying to work around constraints later.

Example: A specialty chemicals company brought Lintyco into their formulation review for a new line of industrial cleaners. By understanding the chemistry early, we recommended specific container materials and filling equipment that accommodated the product’s unique characteristics. Their competitor launched a similar product line six months earlier using standard packaging—and spent eight months troubleshooting seal failures and container degradation before finally re-engineering their packaging at 3X the cost we’d originally quoted.

Build Redundancy Into Your Supply Chain

Chemical operations can’t tolerate packaging supply disruptions. A production line without containers to fill is just expensive floor space.

High-Performing Approach: Maintain qualified backup suppliers for critical packaging components. This doesn’t mean dual-sourcing everything (which fragments volume and increases cost), but rather having pre-qualified alternatives with documented compatibility that can activate quickly if needed.

Cost Impact: This approach typically adds 2-4% to packaging costs (from maintaining dual qualifications and smaller volume splits) but prevents the 100% cost of production downtime when primary suppliers have issues.

Partner With Engineering-Focused Suppliers

There’s a fundamental difference between packaging distributors (who sell you what’s in their warehouse) and packaging engineers (who design solutions specific to your needs).

How to Identify Engineering-Focused Partners:

- They ask detailed questions about your chemistry, process, and supply chain before recommending solutions

- They request your SDS and reference it specifically in their proposals

- They offer Factory Acceptance Testing (FAT) and Site Acceptance Testing (SAT) as standard practice

- Their proposals include total cost of ownership analysis, not just equipment pricing

- They maintain ongoing technical support relationships, not just transactional sales

Lintyco’s Approach: We don’t sell generic packaging equipment. We engineer complete filling systems designed around your specific chemical properties, regulatory requirements, and operational constraints. This includes FAT at our facility, supervised installation, SAT at your site, and ongoing technical support as your operation evolves.

Our chemical packaging solutions range from standalone filling stations for small-scale operations to complete turnkey lines handling thousands of containers per shift. Every system is designed with compliance, safety, and operational reliability as non-negotiable requirements.

Questions From Other Procurement Managers

Q:”How do I know if I need ATEX/IECEx certification for my equipment?”

A:If your material has a flash point below 60°C (140°F) or if it’s a combustible powder, you’re almost certainly in hazardous area classification. But don’t guess—this requires a formal hazardous area classification study by a qualified industrial hygienist or safety engineer.

Once you have that classification (typically Zone 0, 1, or 2 for gases/vapors, or Zone 20, 21, 22 for dusts), your equipment must be certified for that zone. Operating non-certified equipment in classified areas isn’t just regulatory non-compliance—it’s criminal negligence if an incident occurs.

Budget Impact: ATEX/IECEx certified equipment typically costs 25-45% more than standard versions, but this is non-optional for hazardous areas.

Q:”Can we use reconditioned containers to save money?”

A:For many applications, yes—reconditioned drums and IBCs offer excellent value. Licensed reconditioning facilities clean, inspect, and certify containers to meet UN standards, making them fully compliant for hazardous materials.

Critical Requirements:

- Only use containers reconditioned by licensed facilities with full traceability

- Verify the reconditioning certificate matches your specific chemical and packing group

- Establish maximum age limits (most reconditioners recommend 5-7 year maximum life)

- Never recondition containers that previously held incompatible chemicals

Cost Reality: Reconditioned steel drums cost 40-55% less than new. Reconditioned IBCs cost 30-45% less than new. For high-volume operations, this translates to $50,000-150,000 annual savings.

Risk: The primary failure mode is suppliers cutting corners on cleaning and inspection. Stick with established reconditioners who carry appropriate liability insurance and provide certificates of reconditioning with batch-level traceability.

Q:”What’s the real maintenance cost for automated filling equipment?”

A:Plan on 5-8% of equipment purchase price annually for preventative maintenance, consumables, and minor repairs. For example, a $60,000 filling line will cost approximately $3,000-4,800/year to maintain properly.

This includes:

- Pump rebuild or replacement (annually for high-duty cycle applications)

- Valve and seal replacement